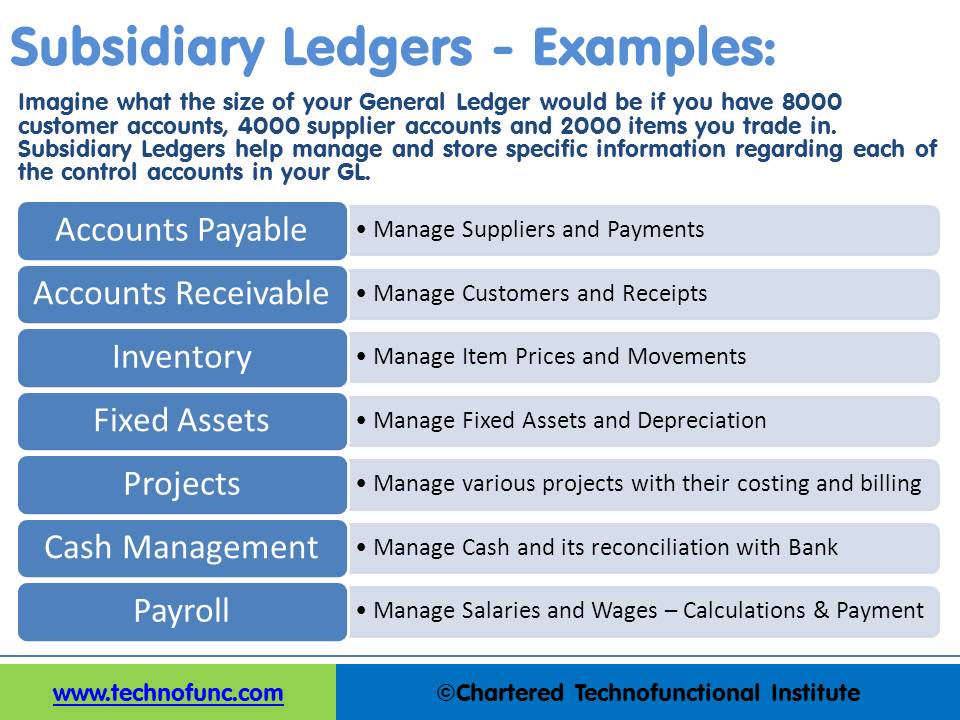

Some of the More Common Subsidiary Ledgers Are

Start studying Subsidiary Ledger. Question 13 of 40 Score.

Subsidiary Ledger Account Definition Examples Top 3 Types

Subsidiary ledger can be defined as.

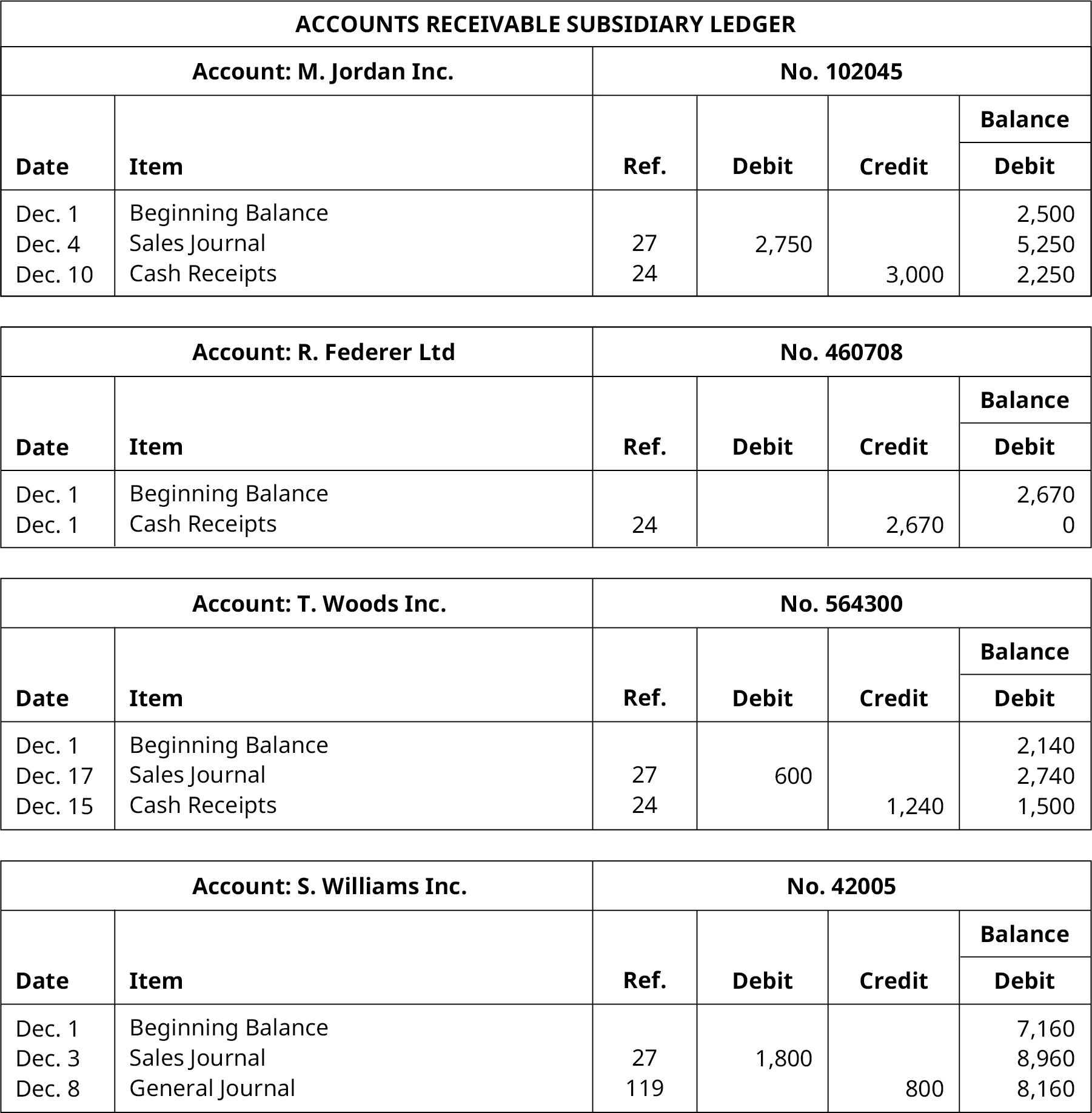

. It is much easier to review data when it is organized and grouped together. Accounts receivable subsidiary ledger where data relating to individual buyers are kept. 25 of possible 25 points Some of the more common subsidiary ledgers are.

Subsidiary ledgers are groups of accounts that are of the same type such as each customer account that is totaled and posted in the balance of accounts receivable. In subsidiary ledgers individual ledger accounts are maintained in alphabetical order. SUBSIDIARY LEDGERS SUBSIDIARY LEDGERS.

This record groups all of the vendors and. Here are some common types of subsidiary ledgers that businesses may decide to create. The accounts receivable is the.

Learn vocabulary terms and more with flashcards games and other study tools. One advantage of using a subsidiary ledger includes the detailed information maintained in the subsidiary ledger. A selling company lends money to a customer company to be used to purchase goods from the selling company.

Learn vocabulary terms and more with flashcards games and. Some of the more common subsidiary ledgers are. Two common subsidiary ledgers are the Accounts Receivable Ledger and the Accounts Payable Ledger.

Accounting Glossary Subsidiary ledger definition including break down of areas in the definition. A subsidiary ledger contains the details to support a general ledger control account. B Accounts Receivable and.

A subsidiary ledger is a group of similar accounts whose combined balances equal the balance in a specific general ledger account. Some of the more common subsidiary ledgers are accounts receivable and accounts payable subsidiary ledgers A cash refund paid to a customer who overpaid an account receivable is recorded in the cash payments journal. Payroll subsidiary ledger is used to manage both salaries and wages.

List of individual subaccounts and amounts with a common characteristic linked to a controlling account in the general ledger. By Obaidullah Jan ACA CFA and last modified on Oct 10 2014 All Chapters in Accounting. Accounts payable subsidiary ledger and fixed assets subsidiary ledger are other commonly used subsidiary ledgers.

The Payroll subsidiary ledger is used to process all types of payroll transactions for the purpose of computing and paying your salaried employees or time and labor-based contractors. Subsidiary ledgers can be. How each company sets up their bookkeeping will depend on the business needs.

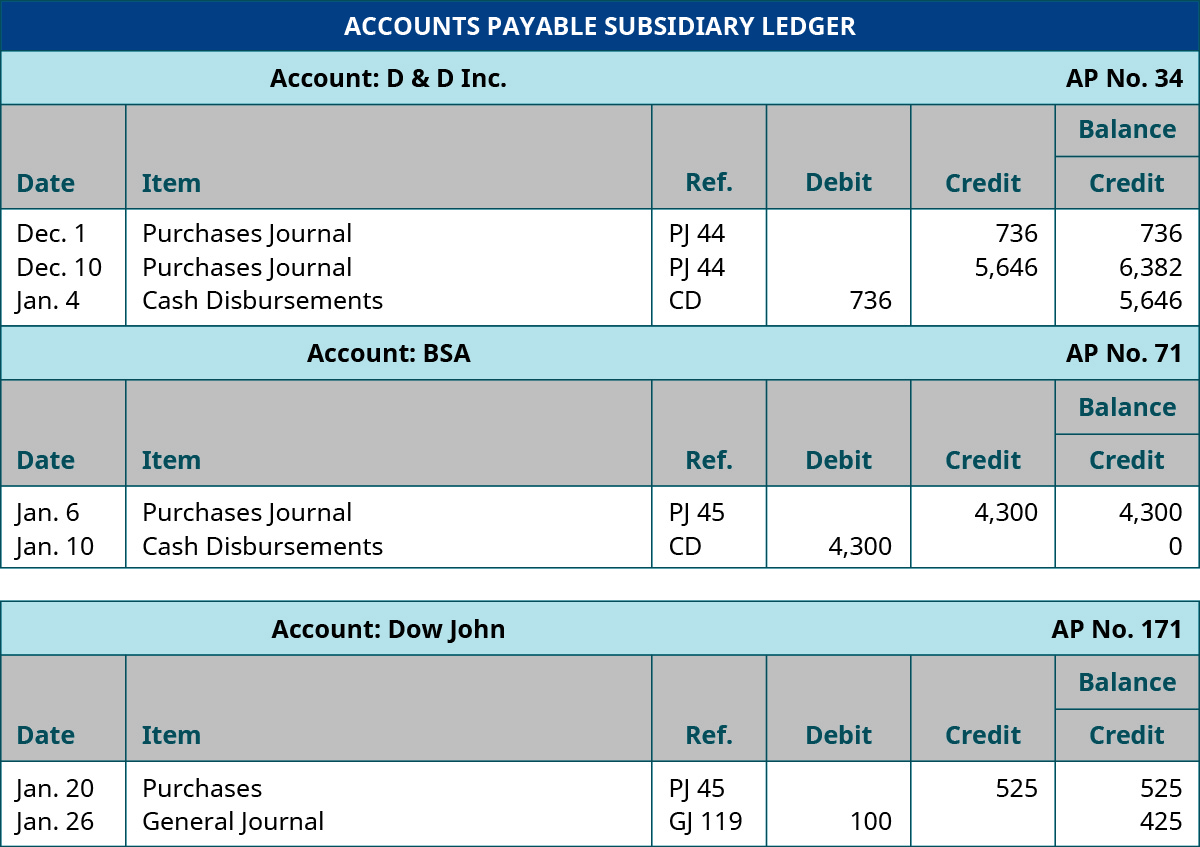

Take the accounts payable ledger for example. You can record calculations payments made to each of the employees in this sub-ledger. If a business uses control accounts there are two options with subsidiary ledgers either the subsidiary ledger itself forms part of the double entry bookkeeping system and the control account is for information only or the control.

The general ledger will normally contain a control account for each subsidiary ledger eg. The general ledger is nothing more than the total of the balances in the subsidiary ledgers. A company might keep a subsidiary ledger for its customer accounts each of which connects to the accounts receivable totaled in the general ledger.

A subsidiary ledger is useful to accountants and bookkeepers for a variety of reasons. For instance the subsidiary ledger for accounts receivable contains the information for each of the companys credit sales to customers each customers remittance return of merchandise discounts and so on. Examples of subsidiary ledgers are the accounts payable ledger accounts receivable ledger fixed assets.

Definition of Subsidiary Ledger. However they are usually only created for areas in which there are high transaction volumes which limits their use to a few areas. Sales ledger purchase ledger cash book etc.

Each vendor listed in the accounts payable ledger includes detailed transaction information. Accounts Payable Accounts Receivable and Owners Equity subsidiary ledgers. First it groups related accounts into one ledger that can be easily totaled and analyzed.

Two common subsidiary ledgers. Analyzing the definition of key term often provides more insight about concepts. The ledger includes each invoice the date received the dollar amount and every payment mailed to the vendor.

The subsidiary ledgers have all the detail. Start studying Subsidiary Ledger. A Accounts Payable Accounts Receivable and Owners Equity subsidiary ledgers.

Accounts payable subsidiary ledger is due where data relating to individual creditors are kept. Some of the commonly used subsidiary ledgers are Fixed Assets Accounts Payable Accounts Receivable Projects and Inventory and they all send the financial data to General Ledger. The general ledger account that summarizes a subsidiary ledgers account balances is called a control account or master accountFor example an accounts receivable subsidiary ledger customers subsidiary ledger includes a separate.

Some of the more common subsidiary ledgers are accounts receivable and accounts payable subsidiary ledgers Affter Accounting system has been set up what is the next step.

Technofunc Example Of Subsidiary Ledgers

Prepare A Subsidiary Ledger Principles Of Accounting Volume 1 Financial Accounting

Describe And Explain The Purpose Of Special Journals And Their Importance To Stakeholders Principles Of Accounting Volume 1 Financial Accounting

Comments

Post a Comment